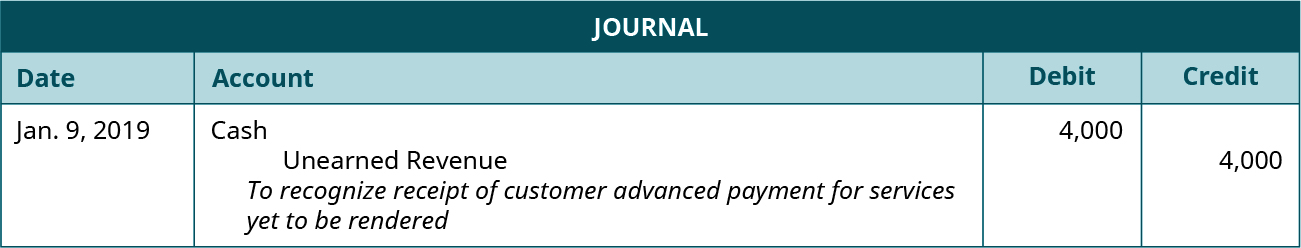

The system will automatically calculate the tax liabilities and gross pay for you. It will generate payroll journal entries on your behalf that you can present at tax time. If you don't have a trusty bookkeeper, accounting software can save you here. DUE TO DUE FROM JOURNAL ENTRIES EXAMPLES SOFTWARE To learn more about payroll and other employee topics, check out our resource hub.Double-entry bookkeeping, in accounting, is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different account. This lesson will cover how to create journal entries from business transactions. The DEBIT amounts will always equal the CREDIT amounts.įor another example, let's look at the transaction analysis we did in the previous chapter for Metro Courier (click Transaction analysis):ġ.The DEBITS are listed first and then the CREDITS.The entry must have at least 2 accounts with 1 DEBIT amount and at least 1 CREDIT amount.When a business transaction requires a journal entry, we must follow these rules: Journal entries are the way we capture the activity of our business. The owner invested $30,000 cash in the corporation. We analyzed this transaction by increasing both cash (an asset) and common stock (an equity) for $30,000.

We learned you increase an asset with a DEBIT and increase an equity with a CREDIT. The journal entry would look like this:Ģ. DUE TO DUE FROM JOURNAL ENTRIES EXAMPLES SOFTWARE.

#Due to due from journal entries examples how to#

DUE TO DUE FROM JOURNAL ENTRIES EXAMPLES HOW TO.

0 kommentar(er)

0 kommentar(er)